hotel tax calculator bc

State has no general sales tax. Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax.

The period reference is from january 1st 2022 to.

. Type of supply learn about what. Most goods and services are charged. All other hotels with 81-160 rooms is 15 and 50 for hotels with more than 160 rooms.

Calculate the total income taxes of the British Columbia residents for 2021. Current GST and PST rate for British-Columbia in 2021. Calculate the total income taxes of the British Columbia residents for 2022.

If you make 52000 a year living in the region of Ontario Canada you will. See reviews photos directions phone numbers and more for the best Taxes-Consultants Representatives in Piscataway NJ. The rate you will charge depends on different factors see.

The maximum MRDT rate is 3. Hotel Occupancies and New Jersey Taxes. The state hotel occupancy tax rate is 6.

Piscataway is located within Middlesex County. GST 5 PST 7 on most goods and services. To get the hotel tax rate a percentage divide the tax per night by the cost of the room before taxes.

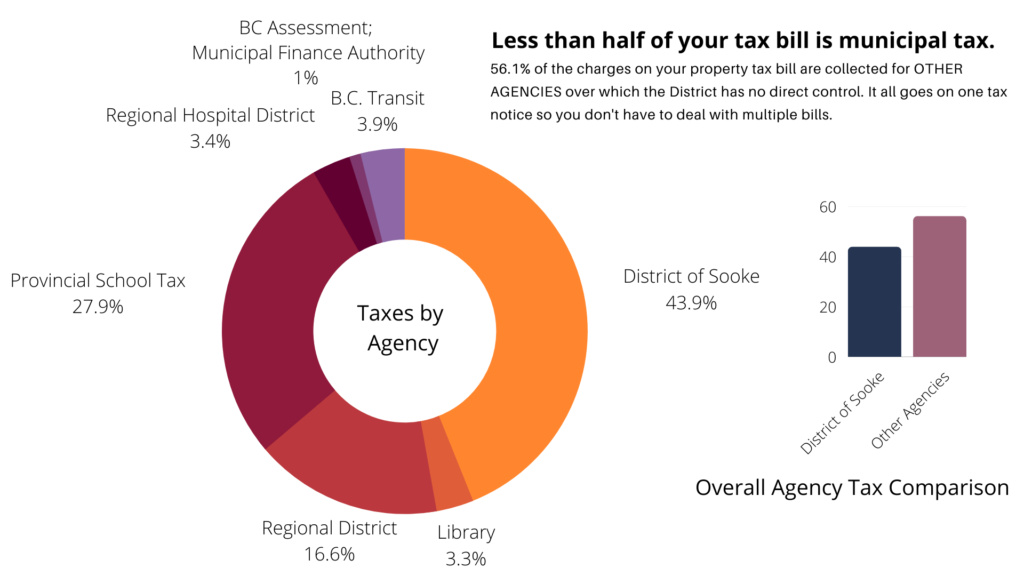

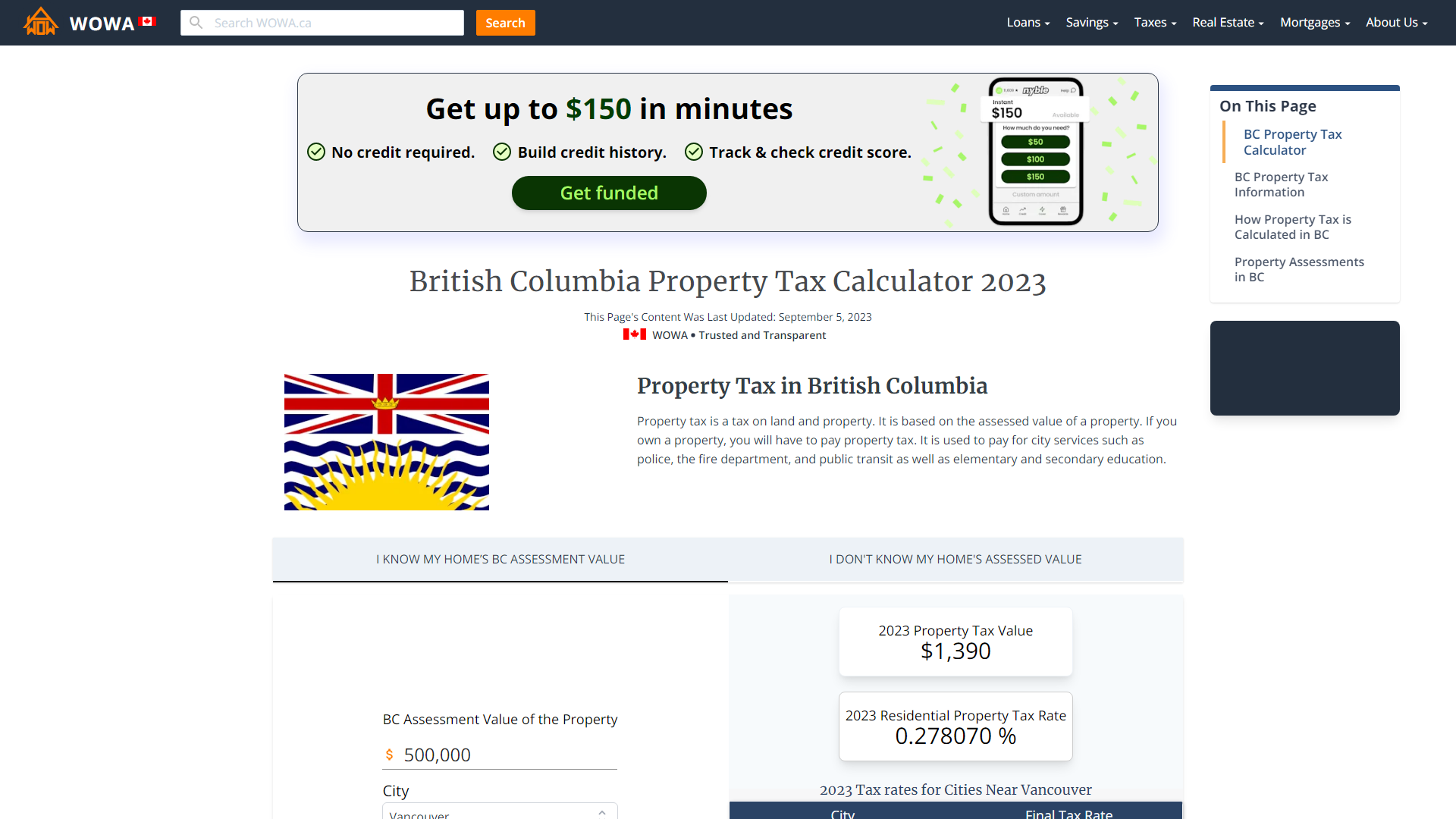

However this tax credit is reduced by 356 for income above. In the province of British Columbia your tax rate can be as low as 506 if your annual income is 43070. The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada.

Hotels in most parts of BC will be 15 5 GST 8 PST short term. Hotel Tax Calculator AlbertaYou can also explore canadian federal tax brackets provincial tax brackets and canadas federal and provincial tax rates. And as high as 205 if your income is over 227091.

Including the net tax income after tax and the percentage of tax. 4 Specific sales tax levied on accommodations. To increase the rate in their area participating.

Their tax rates see MRDT Participating Municipalities Regional Districts and Eligible Entities below. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts.

The following table provides the GST and HST provincial rates since July 1 2010. Multiply the answer by 100 to get the rate. This includes the rates on the state county city and special levels.

If payment is madefrom an individuals account the purchase is subject to Sales Tax the State Occupancy. For the 2021 tax year individuals with an income below 21418 can deduct up to 481 from their income tax bill. 2021 Income Tax Calculator Canada.

To calculate the subtotal amount and sales taxes from a total. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations. The average cumulative sales tax rate in Piscataway New Jersey is 663.

Hotel Room Rates and Taxes. For example the total cost of a.

After Tax Calculator Clearance 53 Off Ilikepinga Com

Hotel Revenue Management Formulas Kpis Calculations Use Cases Upstay

British Columbia Property Tax Rates Calculator Wowa Ca

Best Tax Return Softwares In Canada 2022 Greedyrates Ca

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

:max_bytes(150000):strip_icc()/494331203-56a82eec5f9b58b7d0f15dd3.jpg)

Gst Hst Information For Canadian Businesses

The History Of Property Taxes Tax Ease Texas Property Tax Loans

How To Calculate Canadian Sales Tax Gst Hst Pst Qst 2020 Sage Advice Canada English

Income Tax Calculation A Y 2021 22 New Income Tax Rates 2021 New Tax V S Old Tax A Y 2021 22 Youtube

After Tax Calculator Clearance 53 Off Ilikepinga Com

Kansas Sales Tax Rate Rates Calculator Avalara

Efile Review 2022 Is This Low Cost Tax Prep Really Less Taxing

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca